How to Calculate Beta of a Portfolio

PORTFOLIO SERVICES - Upload your portfolio in seconds from any broker and this unique feature helps you to weed out underperforming companies and invest in better quality companies. The volatility of a security or portfolio against a benchmark is called Beta.

How To Calculate Beta With Pictures Wikihow

The beta denoted as Ba in the CAPM formula is a measure of a stocks risk volatility of returns reflected by measuring the fluctuation of its price changes relative to the overall market.

. Think of it as the money that ends up in your pocket. Thus beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. If you have already deducted your variable expenses from total sales now subtract fixed expenses to calculate the operating income.

However unlike a beta of less than 1 this means a stock is highly volatile ie. Beta β is a measure of volatility or systematic risk of a security or portfolio in comparison to the market as a whole. That volatility can increase the risk in an individuals stock portfolio relative to the broader market.

Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole. The Beta on financial pages. Read more Capital Asset Pricing Model for calculating the rate of return of a stock or.

Building An Investment Portfolio. In finance the beta β or market beta or beta coefficient is a measure of how an individual asset moves on average when the overall stock market increases or decreases. Beta of more than 1 this also means a stock is not very correlated to the market.

To calculate the expected rate of return on a stock or other security you need to think about the different scenarios in which the asset could see a gain or loss. Fixed expenses include advertising insurance rent utilities and payroll wages. It is calculated using regression analysis.

This sound more scary than it is. Operating income is the total sales less all operating expenses except interest and taxes. The Asset and Portfolio Management Certificate Program is designed to help current and aspiring financial professionals employ the best practices when putting together an investment portfolio.

First we need to calculate the standard deviation of each security in the portfolio. Youll learn about key terminology investment products and asset allocation strategies to maximize return on investments. Gross profit margin is your profit divided by revenue the raw amount of money madeNet profit margin is profit minus the price of all other expenses rent wages taxes etc divided by revenue.

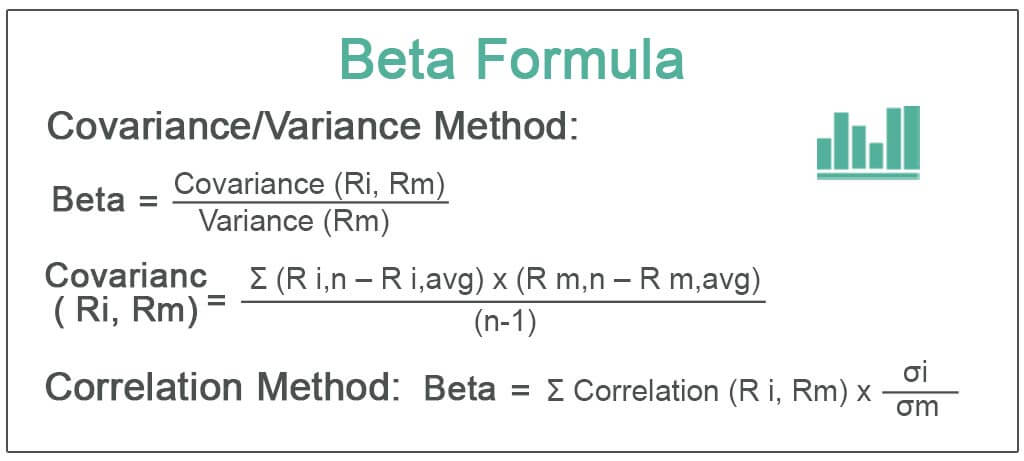

It is used in the capital asset pricing model. Calculate the standard deviation of each security in the portfolio. The Beta is calculated in the CAPM model CAPM Model The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of risk.

STOCK OF THE MONTH - Every 10th of the month you will receive a handpicked stock from our CIO-Sunil Damania. If you have a slightest of the hint regarding DCF then you would have heard about the Capital Asset Pricing Model CAPM CAPM The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of riskIt also considers the volatility of a particular security in relation to the market. Beta of less than 0 ie.

More reactive to price movements in the broader market. It is used in the capital. For each scenario multiply that amount of gain or loss return by its probability.

Discover how to assess opportunities diversify portfolios. We track advise you on your portfolio 247. In other words it is the stocks sensitivity to market risk.

Stock with lower volatility and expects less return. Risk-free rate r f the interest rate available from a risk-free security such as the 13-week US. The returns for the portfolio or any asset whose beta we wish to calculate and the market returns.

In short Beta is measured via a formula that calculates the price risk of a security or portfolio against a benchmark which is typically the broader market as measured by the SP 500 Index. While gross profit margin is a useful measure investors are more likely to look at your net profit margin as it shows. I also like to access historical closing prices on a particular date.

Calculating CAPM Beta in the xts World. Stock is more volatile than the market but expects higher return. You can use a calculator or the Excel function to calculate that.

Calculate operating income. I can easily pull in stock quotes betas and dividends. The tendency of.

Lets say there are 2 securities in the portfolio whose standard deviations are 10 and 15. How To Calculate Expected Return. It also considers the volatility of a particular security in relation to the market.

The default index used for calculations is SPY PortfolioBetaPortfolio PortfolioVolatilityPortfolio Our Clients. Lets go to the xts world and use the built-in CAPMbeta function from PerformanceAnalyticsThat function takes two arguments. Most people use the SP 500 Index to represent the market Beta is also a measure of the covariance of a stock with the market.

The formula for Beta is Covariance divided by variance. We can make things even more efficient of course with built-in functions. However the T-bill is generally accepted as the best representative of a risk-free security because its return.

Expected return on an asset r a the value to be calculated. It is used in the capital. Calculate your Portfolios Beta and Volatility with the functions as shown below.

Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole. A negative beta this means a stock is inversely correlated to the market. I use MarketXLS to manage my personal portfolio.

While low-beta stocks pose less risk but also lower returns. It is used in the capital asset pricing model. For instance if a companys beta is equal to 15 the security has 150 of the volatility of the market average.

Thus beta is referred to as an assets non-diversifiable. Treasury billNo instrument is completely without some risk including the T-bill which is subject to inflation risk.

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

How To Calculate The Beta Of A Portfolio Youtube

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

0 Response to "How to Calculate Beta of a Portfolio"

Post a Comment